Do You Know What an ABA Number Is? Explaining Its Importance

Dec 08, 2023 By Susan Kelly

Have you ever glanced at the bottom left of your check and wondered about that nine-digit number? That's not your account number; it's an ABA routing number or a bank routing number. Consider it your bank's unique identifier or 'numerical address.'

You probably don't have your bank's ABA number memorized, and that's okay. But these nine digits play a significant role in everyday financial dealings like online payments and setting up direct deposits. Stick around, and you'll find out what this number is, why it's important, how to locate it, and other handy info to keep your financial matters ticking over smoothly.

What is an ABA Number?

So, what's the big deal about this ABA number? Created by the American Bankers Association (hence the ABA part), its primary job is to ensure money reaches its intended destination. It's like a financial GPS for your transactions, guiding money between banks.

Instead of relying on reading a bank's name from a check (which can be error-prone), routing numbers let bank staff and machines process payments quickly and correctly. The banks sending and receiving money use this number to streamline their transaction processes. Plus, it's a trust factor in the banking world. Sellers know they're getting legit funds from an actual bank, and buyers have peace of mind that their payments are traceable and secure.

Are you curious about what those digits in the routing number mean? Let's break it down:

- The first four digits represent the Federal Reserve Bank in charge of banks in a specific area.

- The next four are all about identifying your bank, like its own ABA ID number.

- And that final digit? It's a check digit used to confirm the validity of the routing number.

Not just any bank can snag an ABA number banking. They need to be federally or state chartered and eligible to have a Federal Reserve Bank account.

To get one of these numbers, a financial institution has to go through Accuity, the official keeper of ABA Routing Numbers. New banks? They need to apply to Accuity to get their own ABA routing number.

ABA Numbers and Bank Account Numbers

When it comes to banking, two numbers are super important: your ABA number and your account number.

- Think of the ABA number banking as a tag for your bank. It points to the financial institution where your account lives.

- Your bank account number? That's more personal. It's like your account's unique ID, whether a checking, savings or any other type of account.

History of the ABA Number

As we mentioned, the ABA number is all about identifying the bank holding your account. It's a key player in ensuring financial transactions (like transferring money) go off without a hitch. In 1910, the American Bankers Association rolled out these routing numbers. Initially, they were just for sorting out checks. Fast forward to today, and they've evolved to keep up with the times – think online banking, electronic funds transfers, and the like. They're pretty much indispensable for everyday banking tasks.

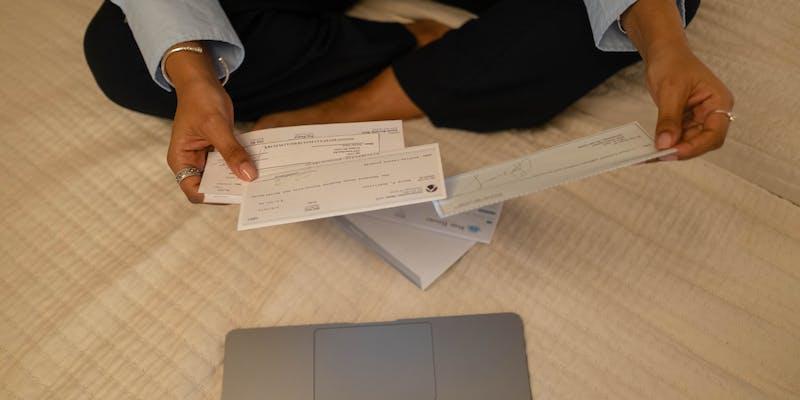

ABA Number on a Check

Trying to find the bank ABA number on a check? Look at the bottom line of the numbers.

Among all those digits, the ABA number is the first nine-digit string on the left. It starts with either 0, 1, 2, or 3. Right next to it, you'll usually find your account and check numbers.

Just be careful not to mix these numbers up. Getting them wrong can mess up check processing and online payments.

Finding Your ABA Number Without a Check

Lost your checkbook? No worries. There are several other ways to find your ABA routing number when handling money transfers.

Bank Statements

First up, check your bank statements. Whether you get them in the mail or as e-statements, they usually list the ABA routing number and your account details.

Bank Websites

Most banks know everyone after this number, making their ABA numbers easy to find on their websites. But remember, if you're with a big national bank, the routing number might vary by state or type of transaction (like wire transfers or ACH payments).

Ask Your Local Bank

When in doubt, give your bank a call or, if you're a fan of face-to-face interactions, visit a local branch. They'll tell you the correct ABA routing number for your needs.

ABA Online Lookup Tool

And then there's the ABA's tool – a free online lookup service for routing numbers. Handy, right? Just remember, there's a limit: only two lookups per day and ten per month. Also, remember that some banks use different routing numbers depending on the state or transaction type.

When You'll Need Your ABA Number

Your ABA routing number isn't something you'll use daily, but it's pretty essential for several everyday financial tasks:

- Direct (or ACH) Deposits: Got a new job? Setting up your salary to go directly into your bank account usually requires your ABA and account numbers.

- Wire Transfers: You'll need this number if you're sending or receiving money, especially internationally.

- IRS Direct Deposits: Fancy getting your tax refund straight to your bank? The IRS needs your bank ABA number for that.

- Paying Bills or Friends: Whether you're settling utility bills online or sending money to friends via mobile apps, your routing number comes into play.

- Investments and Transfers: Moving money to your retirement account or between different banks? You'll likely need this number for setting up ACH transfers.

ABA vs. ACH Numbers: Clearing the Confusion

The terms ABA and ACH often get jumbled up. While ABA numbers might sometimes be called ACH numbers, they're not similar.

ACH stands for Automated Clearing House, a network used for bank electronic funds transfers. Think of ACH as the digital highway for moving money around.

Unlike wire transfers, which are usually for more significant sums, ACH is more about petite, maybe even regular, payments. It's the system behind direct deposits, automatic bill payments, and online transactions. Most banks and credit unions use the ACH network for online bill-paying services.

So, when you set up your paycheck to drop directly into your account or automate your student loan payments, that's ACH at work. And yes, you'll often need to provide both your account and ABA numbers for these transactions.