Why You Need a Savings Plan and How to Create One

Dec 06, 2024 By Darnell Malan

Are you barely getting by or worried about your financial future? You are not alone. Many Americans live paycheck to paycheck; few have any savings whatsoever. But having a good savings plan is essential to your financial well-being and peace of mind. Why You Need a Savings Plan

Why You Need a Savings Plan

A savings plan is more than a financial tool; it's a roadmap to your future security and peace of mind. Without a clear-cut strategy for lying by money, one could be caught off guard by any abrupt turn that life may take or not attain the long-term goals set.

Financial Security and Peace of Mind

A savings plan is a financial cushion against unexpected expenses or income disruptions. It provides a safety net through which you can weather job losses, medical emergencies, or significant repairs without sliding into high-interest debt. This financial cushion directly reduces stress and increases peace of mind in daily living.

Goal Achievement and Future Planning

A well-structured savings plan aligns your financial habits with your aspirations. It can make all these dreams, whether you're buying a house, retiring comfortably, or planning for your children's education, a reality. It will help you prioritize your spending and facilitate long-term resource allocation toward things that mean much more to you.

Financial Discipline and Habit Formation

A savings plan reinforces good financial discipline and helps build positive money habits. By continually setting aside some portion of your income, you adopt a spirit of delayed gratification and become very thoughtful about spending. This results in better overall financial health, improved credit scores, and increased opportunities to build wealth over time.

How Much You Should Be Saving Each Month

However, how much you should save per month is particular to your situation and goals. A good rule of thumb might be 20% of your income. This is also reflected in the "20/30/50 rule," where you take 50% for needs, 30% for wants, and 20% for savings and debt reduction.

Factors Influencing Your Savings Rate

Your ideal savings rate will depend on several factors, including the following:

- Income level

- Cost of living in your area

- Current debts and financial obligations

- Short-term and long-term financial goals

- Age and retirement timeline

Adjusting Your Savings Plan

If saving 20% seems too ambitious, try starting with a lower percentage and increasing it over time. The important thing is to save regularly. Consider ramping up the savings when your income increases or your expenses decrease.

Setting Financial Goals to Guide Your Savings

The whole basis of any good savings plan is a well-set financial goal. Without proper goals, it will be like sailing without a compass. Setting specific, measurable, achievable, relevant, and time-bound-or SMART-goals-indicates the course you will take in treading your path toward your financial goals.

Short-term vs. Long-term Goals

Consider both near-term and long-term goals as you develop your savings plan. Short-term goals include an emergency fund or money stored away for a vacation, whereas long-term goals could be retirement or buying a house. It would help to balance your goals to be prepared for immediate needs and secure for the future.

Prioritizing Your Goals

Not all financial goals in life are equal. First, assess your situation and then prioritize your goals based on what needs to be done and how important they are. For instance, building an emergency fund should take precedence over saving for a fun purchase. In prioritizing your goals, you should better apportion your resources and remind yourself what is more important.

Quantifying Your Goals

Vague goals become tangible targets once you define them in terms of dollar amounts and time. Instead of "saving for retirement," for example, you can plan to "save $500,000 by age 65." Extreme specificity gives direction and drive, allowing you to easily see where you are in meeting your target and revise your strategy if needed.

Where to Put Your Savings for the Best Returns

Where you stow your cash makes all the difference when trying to grow your savings. Let's explore some of the best options that will balance your need for great returns with risk management and accessibility.

High-Yield Savings Accounts

High-yield savings accounts are excellent choices for short-term savings and emergency fund-building. These kinds of accounts often earn interest rates significantly higher than that of a regular savings account. This helps your money grow faster while still being highly liquid.

Certificates of Deposit (CDs)

If one does not have an issue with freezing one's money for a fixed period, CDs will offer higher interest rates compared to savings accounts. With better returns, like locking your money away for months or even years, the longer terms tend to get higher interest rates.

Investment Accounts

Retirement would be a good reason to open an investment account for long-term savings goals. While they come with more risks, other options include index funds or ETFs that could yield higher returns. These accounts will enable one to invest in a diversified portfolio of stocks and bonds to grow one's wealth more aggressively.

Retirement Accounts

Remember the benefits of tax-advantaged retirement accounts, such as 401(k)s and IRAs, for building wealth. Save for one's future options, with potential tax benefits occasionally, with employer matching funds amounting to free money added to your savings.

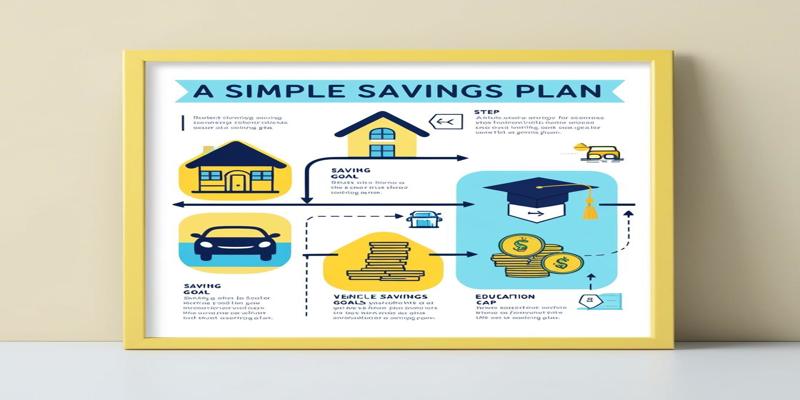

Steps to Start a Simple Savings Plan

Setting up a savings scheme is not rocket science. Follow a few easy steps, and you are well on your way to a sound financial future. Here's how:

Set Clear Goals

Begin by defining what you're saving for. Whether it's an emergency fund, a down payment on a house, or a dream vacation, having specific goals will motivate you. Prioritize your objectives and set realistic timescales for each.

Analyze Your Income and Expenses

Take a hard look at your monthly cash flow. For a few weeks, track your spending to find ways to cut back. This step will tell you how much you can safely deposit every month.

Choose the Right Savings Vehicle

Explore various types of savings accounts that suit your needs. High-yield savings accounts, certificates of deposit (CDs), and money market accounts typically offer better interest rates than standard savings accounts.

Conclusion

Prudently beginning to save is essential to financial security and peace of mind. The secret of success lies in consistency and commitment. It is okay if you start small, but begin today. Periodically review your plan and update it according to changes in your life's circumstances.